Debt

Debt and Debt Service Summary

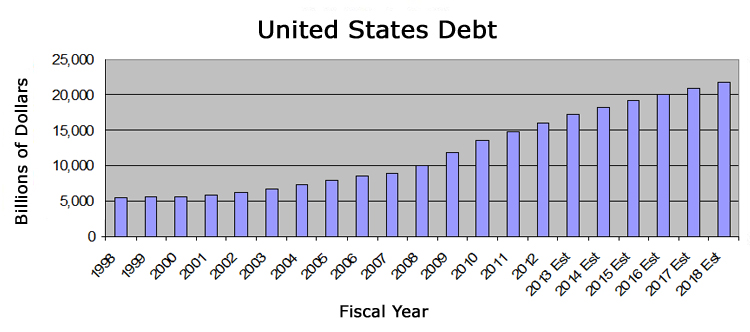

Our gross treasury debt has ballooned from $9.986 trillion in FY 2008 to $19.539 trillion in FY2016 and is expected to be at $20.354 trillion by the end of September 2017. If you go back further to 1998, the Debt has more than tripled from $5.478 Trillion in FY 1998 to $19.539 in FY 2016 and is projected by OMB to reach $23.647 by 2022. This is unsustainable. To review the current status of the debt, you can go to the nation debt clock at usdebtclock.org.

|

Fiscal Year End |

Federal Debt |

|

in $Millions |

|

| 1998 |

5,478,189 |

| 1999 |

5,605,523 |

| 2000 |

5,628,700 |

| 2001 |

5,769,881 |

| 2002 |

6,198,401 |

| 2003 |

6,760,014 |

| 2004 |

7,354,657 |

| 2005 |

7,905,300 |

| 2006 |

8,451,350 |

| 2007 |

8,950,744 |

| 2008 |

9,986,082 |

| 2009 |

11,875,851 |

| 2010 |

13,528,807 |

| 2011 |

14,764,222 |

| 2012 |

16,050,921 |

| 2013 |

16,719,434 |

| 2014 estimate |

17,794,483 |

| 2015 estimate |

18,627,577 |

| 2016 estimate |

19,333,800 |

| 2017 estimate |

20,095,062 |

| 2018 estimate |

20,870,355 |

| 2019 estimate |

21,640,282 |

If we take action under the Simpson Bowles plan or the other plans addressing the Federal Government’s Fiscal problems, the debt will come down and become more manageable.

To paint debt as a percentage of Gross Domestic Product, debt has increased from 33% of GDP in 2001 to 62% in 2010. Given our present spending pattern, Debt is projected to be 200% of GDP by 2035. If we conform to current law with the Bush Tax cuts reversed, estate taxes reinstated after the Bush era, AMT not patched, and the physicians paid according to current law (rather than the usual doc fix), the Debt is projected to rise to 82% of GDP by 2040. If we follow the Simpson Bowles plan, the Debt is projected to fall to 30% of GDP by 2040. Other plans have similar effects depending on their level of tax increases and expenditure reductions.

The problem with debt is that you have to pay interest on it during its term and either refinance it or pay it off when the obligation matures. By paying interest, you are using tax dollars that could be used elsewhere for better purposes. Our net interest on the debt has actually fallen from FY2008 to FY 2013 from $253 billion to $221 billion as interest rates have decreased substantially during the second great contraction. Despite this current fortuitous circumstance today, the burden of the interest on the national debt is projected by OMB to grow to $551 billion by 2019, more than doubling in 6 years. That interest burden along with the growth of entitlements will dramatically decrease all other programs including defense, food stamps, education, infrastructure repair and modernization,and research unless effective action is taken and taken now.